NG Missile Vessels

FULL MEMBER

- Joined

- Apr 9, 2023

- Messages

- 1,600

- Reaction score

- 0

- Country

- Location

Presenting the human side of data on income tax returns (ITR), a report from SBI Research titled ‘Deciphering Emerging Trends in ITR Filing: The Ascent of the New Middle Class in Circular Migration points out how the average Indian middle class income has risen over the years.

The average income (weighted mean) has grown from Rs 4.4 lakh in financial year 2012-13 (FY13) to Rs 13 lakh in FY22. According to the report, the reasons for this are twofold. One, many taxpayers have transitioned from the lower income group to the upper income group, thereby bumping up the average. Two, there has been a fall in the number of return filers with zero tax liability.

Transition of the middle class

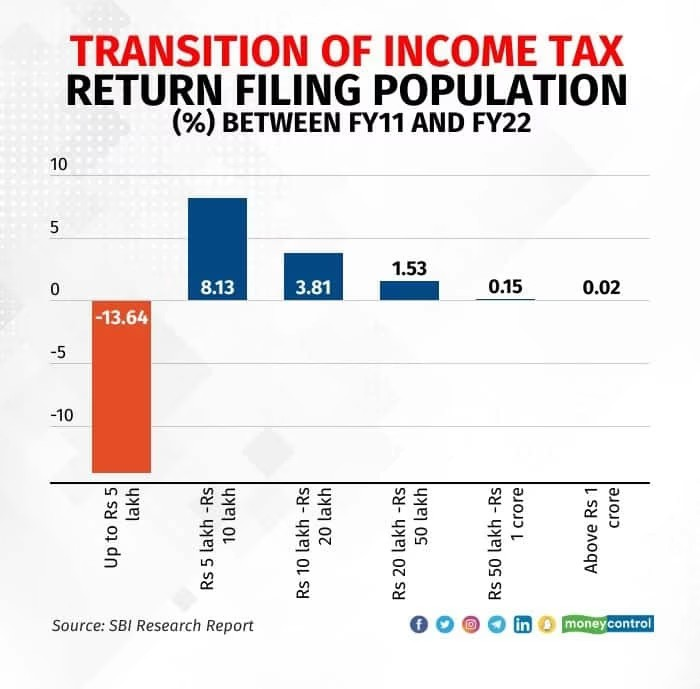

The report sheds light on the transition of the lower middle class to higher income levels over the past 10 years. In FY11, of the 16 million people who filed tax returns, 84 percent belonged to the income group of up to Rs 5 lakh. By FY22, only 64 percent of the 68.5 million ITR filers belonged to this income bracket. That is, compared to FY11, 13.6 percent population had left the lower income strata and migrated upwards by FY22. (see table)

Another big positive has been the significant decline in the number of zero-tax liability returns. That is, tax returns where the individual’s taxable income falls below the basic exemption limit and he/she is not liable to pay any tax. The share of such ITRs has gone down from 84.10 percent in FY11 to 64 percent by FY22. (see table)

Income to go up

Going by the report, the average income is expected to go up further to Rs 49.70 lakh by 2047, helped by a combination of more tax filers and a shift in the distribution of tax filers from the lower to the higher income group. Also, 25 percent of the ITR filers are expected to leave the lowest income strata (annual income of up to Rs 5 lakh) by FY47, SBI Research estimates.

Timely return filing and processing

When it comes to the filing and processing of ITRs, the report points to an improvement in both in recent years. Of the 78 million returns filed in FY22, 75 percent were filed on or before the due date. That is, only 25 percent returns were filed late. This is sharply down from the 60 percent late tax returns in FY19.

For FY23 (the financial year just gone by), the share of late IT returns is expected to come down further to 20 percent. The report attributes this to greater discipline among taxpayers and the simplification of income tax forms and processes.

The processing of returns has also become more efficient in recent years. In FY21, 54 percent of the 59 million returns filed by the due date were processed by that date. In FY23, of the 68 million returns filed by July 2023, 64 percent were processed by the due date. (see table)

Larger workforce, more taxpayers

At a macro level, the report presents projections on the size of the Indian workforce and the taxpayer base. The Indian workforce is expected to go up from 530 million in FY23 to 725 million by FY47. This will be reflected in a rise in the number of tax filers, expected to go up from 70 million in FY23 to 482 million by FY47.

Then, going by past data on state-wise ITR filing, the report shows that the top five states of Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and West Bengal accounted for 48 percent of the ITRs filed for FY22. If you go back further in time, it’s Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and Tamil Nadu that together contributed to the bulk of the rise in the number of ITRs (46 percent of the 481 lakh additional returns) filed between FY14 and FY22.

In terms of growth, among the smaller states, Manipur, Mizoram, and Nagaland clocked a more than 20 percent jump in ITRs filed over the last nine years.

However, as the report points out, this state-wise data must be viewed in terms of migration from states. Take, for example, the ITR data for FY21-22. Of the top six states where most ITRs were filed, three states ― UP, Rajasthan, and West Bengal ― actually exhibited net negative migration.

This runs counter to what one would expect. Simply put, one would expect states experiencing outward migration (people moving to other states for jobs) to have fewer ITR filings. But given that your ITR is linked with your PAN address (likely in the state you belong to), this can be different from your workplace address (in a different state).

The report recommends that the current address on the Aadhaar card be linked to the ITRs, as that may more accurately present the place of work of an individual.

The way forward

The report also makes suggestions on how tax returns can be used to capture the socio-economic and cultural characteristics of the migrant workforce. For example, it talks about further harmonising the PAN-Aadhaar data to better capture the patterns of migration that are happening in pursuit of better job opportunities. The report suggests that ITRs be used to gather information on the location (place of domicile/place of permanent residence/place of work) of taxpayers.

Enabling ITR filing in multiple languages and embedding the tax filing process with artificial intelligence-led assistance is yet another suggestion that has been made.

www.moneycontrol.com

www.moneycontrol.com

The average income (weighted mean) has grown from Rs 4.4 lakh in financial year 2012-13 (FY13) to Rs 13 lakh in FY22. According to the report, the reasons for this are twofold. One, many taxpayers have transitioned from the lower income group to the upper income group, thereby bumping up the average. Two, there has been a fall in the number of return filers with zero tax liability.

Transition of the middle class

The report sheds light on the transition of the lower middle class to higher income levels over the past 10 years. In FY11, of the 16 million people who filed tax returns, 84 percent belonged to the income group of up to Rs 5 lakh. By FY22, only 64 percent of the 68.5 million ITR filers belonged to this income bracket. That is, compared to FY11, 13.6 percent population had left the lower income strata and migrated upwards by FY22. (see table)

Another big positive has been the significant decline in the number of zero-tax liability returns. That is, tax returns where the individual’s taxable income falls below the basic exemption limit and he/she is not liable to pay any tax. The share of such ITRs has gone down from 84.10 percent in FY11 to 64 percent by FY22. (see table)

Income to go up

Going by the report, the average income is expected to go up further to Rs 49.70 lakh by 2047, helped by a combination of more tax filers and a shift in the distribution of tax filers from the lower to the higher income group. Also, 25 percent of the ITR filers are expected to leave the lowest income strata (annual income of up to Rs 5 lakh) by FY47, SBI Research estimates.

Timely return filing and processing

When it comes to the filing and processing of ITRs, the report points to an improvement in both in recent years. Of the 78 million returns filed in FY22, 75 percent were filed on or before the due date. That is, only 25 percent returns were filed late. This is sharply down from the 60 percent late tax returns in FY19.

For FY23 (the financial year just gone by), the share of late IT returns is expected to come down further to 20 percent. The report attributes this to greater discipline among taxpayers and the simplification of income tax forms and processes.

The processing of returns has also become more efficient in recent years. In FY21, 54 percent of the 59 million returns filed by the due date were processed by that date. In FY23, of the 68 million returns filed by July 2023, 64 percent were processed by the due date. (see table)

Larger workforce, more taxpayers

At a macro level, the report presents projections on the size of the Indian workforce and the taxpayer base. The Indian workforce is expected to go up from 530 million in FY23 to 725 million by FY47. This will be reflected in a rise in the number of tax filers, expected to go up from 70 million in FY23 to 482 million by FY47.

Then, going by past data on state-wise ITR filing, the report shows that the top five states of Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and West Bengal accounted for 48 percent of the ITRs filed for FY22. If you go back further in time, it’s Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and Tamil Nadu that together contributed to the bulk of the rise in the number of ITRs (46 percent of the 481 lakh additional returns) filed between FY14 and FY22.

In terms of growth, among the smaller states, Manipur, Mizoram, and Nagaland clocked a more than 20 percent jump in ITRs filed over the last nine years.

However, as the report points out, this state-wise data must be viewed in terms of migration from states. Take, for example, the ITR data for FY21-22. Of the top six states where most ITRs were filed, three states ― UP, Rajasthan, and West Bengal ― actually exhibited net negative migration.

This runs counter to what one would expect. Simply put, one would expect states experiencing outward migration (people moving to other states for jobs) to have fewer ITR filings. But given that your ITR is linked with your PAN address (likely in the state you belong to), this can be different from your workplace address (in a different state).

The report recommends that the current address on the Aadhaar card be linked to the ITRs, as that may more accurately present the place of work of an individual.

The way forward

The report also makes suggestions on how tax returns can be used to capture the socio-economic and cultural characteristics of the migrant workforce. For example, it talks about further harmonising the PAN-Aadhaar data to better capture the patterns of migration that are happening in pursuit of better job opportunities. The report suggests that ITRs be used to gather information on the location (place of domicile/place of permanent residence/place of work) of taxpayers.

Enabling ITR filing in multiple languages and embedding the tax filing process with artificial intelligence-led assistance is yet another suggestion that has been made.

Bullish on India: Average income of middle-class Indians triples from Rs 4.4 lakh in FY13 to Rs 13 lakh in FY22

An SBI Research Report based on income tax returns filed for FY11 to FY22 shows positive trends, such as rise in average income of the middle class and significant decline in the number of returns with zero tax liability.